The federal government offers tax credits to homeowners who make energy-efficient improvements to their homes, including upgrades to HVAC systems.

Tax Credits

The Energy Efficient Home Improvement Credit under Section 25C of the Internal Revenue Code (IRC) offers a financial incentive to homeowners for qualifying improvements. It opens the door for eligible homeowners to potentially receive a tax credit for a portion of the cost of qualifying energy-efficient improvements, such as specific high-efficiency HVAC systems,

Here are the Systems that Qualify

The Tax Credit on qualifying HVAC systems was originally supposed to last through December 31, 2032, however, these may potentially end on December 31, 2025. This remains to be seen but for now, the credits are still available.

Heat Pump Split Systems

- Homeownerswho purchase and place into service qualifying air-source heat pump split system equipment within the tax year may be eligible for a non-refundable tax credit of up to $2000.

- >= 16.0 SEER2

>= 11.0 EER2

>= 8.0 HSPF2 - Individuals who purchase and place into service qualifying packaged air-source heat pump systems within the tax year may be eligible for a non-refundable tax credit of up to $2000.

Heat Pump Package Units

- Homeowners who purchase and place into service qualifying packaged air-source heat pump systems within the tax year may be eligible for a non-refundable tax credit of up to $2000.

- >= 15.2 SEER2

>= 10.0 EER2

>= 7.2 HSPF2

Natural Gas Furnaces

- Individuals who purchase and place qualifying gas-fired forced air furnaces into service within the tax year may be eligible for a non-refundable tax credit of up to $600.

- >= 97% AFUE

Central Air Conditioning

Split Systems

- Homeowners who purchase and place into service qualifying split central air conditioning systems (ducted, ductless, or mixed ducted) within the tax year may be eligible for a non-refundable tax credit of up to $600.

- >= 17.0 SEER2

>= 12.0 EER2

Package Units

- Individuals who purchase and place into service qualifying packaged air conditioning systems within the tax year may be eligible for a non-refundable tax credit of up to $600.

- >= 16.0 SEER2

>= 11.5 EER2

Where to Find Tax Credit-eligible Systems

- Go to the AHRI Directory of Certified Product Performance and click on your corresponding Product Function.

- Enter the brand name (indoor and outdoor unit, if applicable), model number of your equipment (indoor and outdoor unit, if applicable) into the Search bar, and click SEARCH.

- Locate your system’s model number in the search results and click on the AHRI Ref # link.

- On the system’s detail page, look for the button labeled “Download Certificate.”

- Click DOWNLOAD CERTIFICATE to download the AHRI certificate. 25C tax credit eligible equipment will show the text “Potential Eligibility for IRA Tax Credit*” in the top right-hand corner. You can save or print it for your records.

These tax credits apply to Residential Energy Property Expenditures, such as qualifying Heat Pumps, central air conditioners, and natural gas furnaces. Qualifying systems are in effect at the beginning of the year when the property was installed serves as one of the criteria used to determine eligibility for certain equipment under the Federal Energy Efficiency Home Improvement Credit.

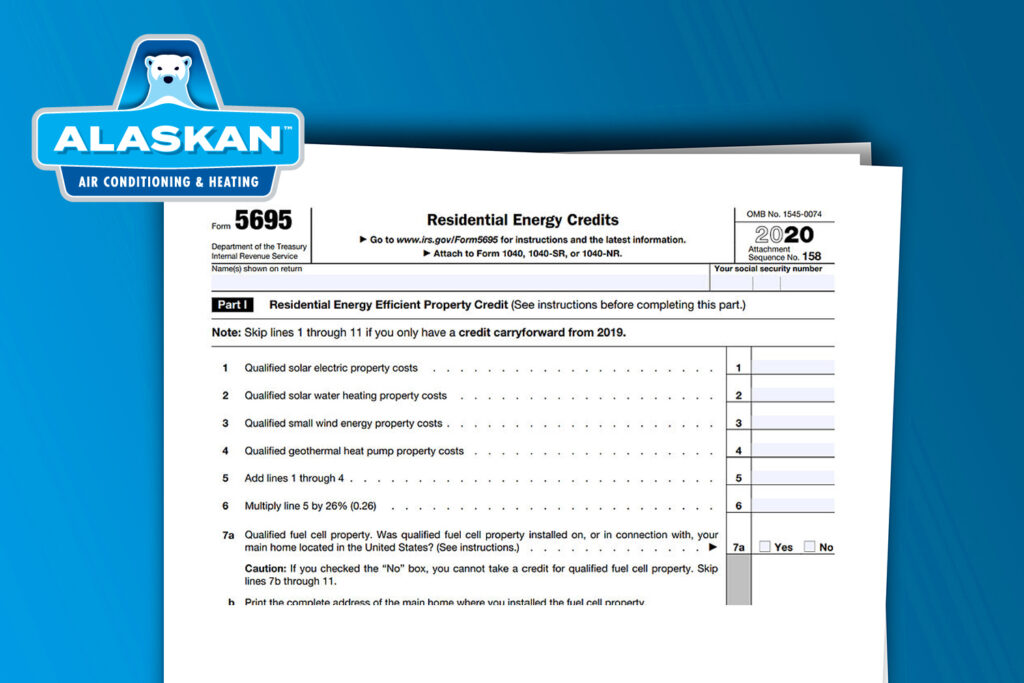

How to Claim the Credit

You will need to file IRS Form 5695, “Residential Energy Credits,” with your federal tax return. You should keep all documentation, including purchase receipts and installation records, and any ENERGY STAR labels, in case of an audit.